INSIGHTS

Latest Insights

Stay up to date on current events that impact the real estate industry.

It’s an Ideal Time to Invest in Commercial Real Estate

July 16, 2024

As pressure grows for banks and sellers to accept lower market values, look for opportunities to acquire commercial real estate at favorable entry points.

Read More →

Investors Currently Earning Outsized Returns in CRE Debt Funds

June 24, 2024

The dislocation between developer demand for financing and the availability of funds from traditional lenders is driving opportunities for alternative lenders.

Read More →

Dallas Metroplex Rising: Fastest Growing Metro in the Country

April 30, 2024

Rapid population growth makes Dallas an ideal market for both real estate developers and the real estate debt investors who fund their projects.

Read More →

These Two Key Factors Make Senior Housing a Great Investment

April 3, 2024

The ongoing surge in demand from baby boomers, significantly unmet by current supply, makes senior housing one of the best investments available in 2024.

Read More →

Entitling a Redevelopment Site in Downtown Los Angeles

March 8, 2024

Learn how we partnered with a successful multi-family developer, realizing an annualized IRR of 30.4% and an equity multiple of 1.7x for our investors.

Read More →

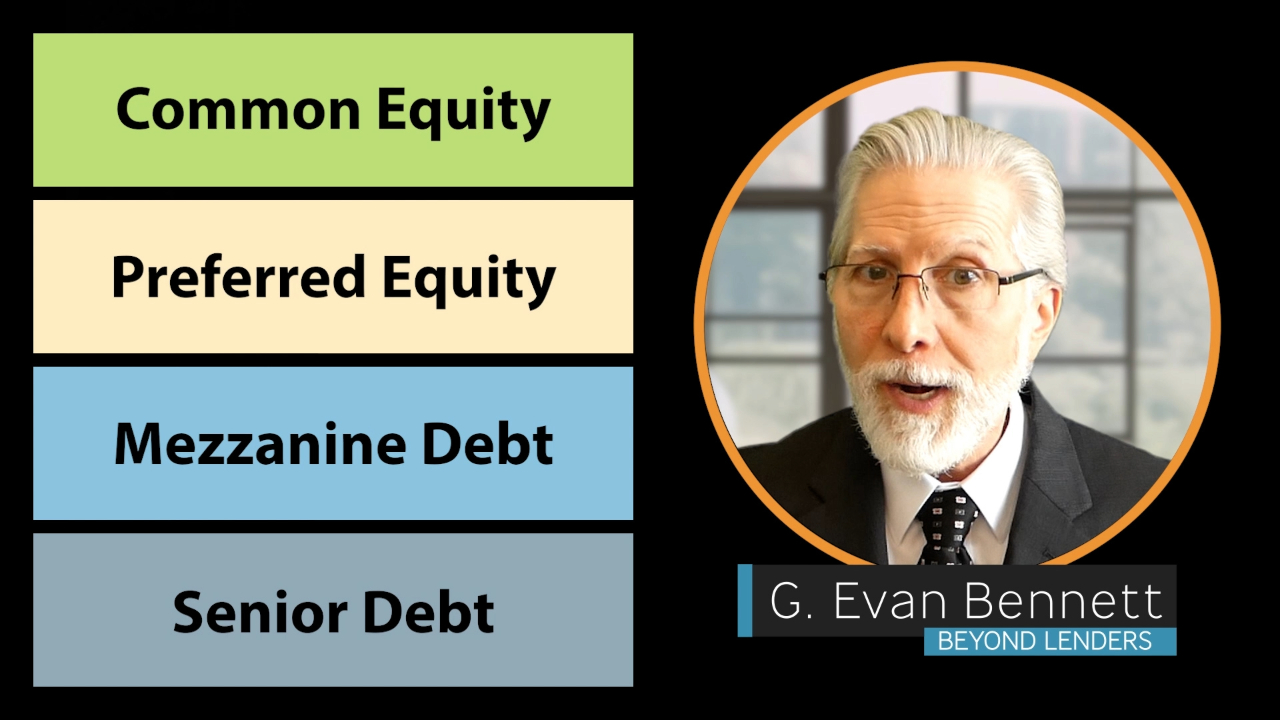

Capital Stack Agility Makes for Outsized Returns in CRE Investing

February 16, 2024

If you’re agile enough to be a sponsor on some deals and a lender on others, get ready to have your pick of commercial real estate investment opportunities.

Read More →

$440 Billion Shortfall to Reset the CRE Market and Ignite Investment Opportunities

January 23, 2024

With $1.6 trillion in commercial real estate loans coming to maturity, the market is going to experience a refinancing shortfall of epic proportions.

Read More →

Remarkable Opportunities for CRE Investment in 2024

December 27, 2023

CRE transactions will finally pick up in 2024 as borrowers struggle to refinance their properties, serving as a catalyst for bargain pricing.

Read More →

Waiting for the Fed Pivot

December 13, 2023

As the full weight of monetary policy is far from yet to be realized, it's ultimately going to take a recession in 2024 to bring on the Fed pivot.

Read More →

Emerging Trends in 2024 for CRE – Part 2

December 1, 2023

Here are the second 5 of 10 emerging trends in commercial real estate for 2024, critical issues for investors to anticipate with opportunistic strategy.

Read More →

Emerging Trends in 2024 for CRE – Part 1

November 14, 2023

The first 5 of 10 emerging trends in commercial real estate for 2024 are critical issues that investor needs to anticipate with opportunistic strategy.

Read More →

Investor Survey Provides Insights on Investments in Office Properties

October 24, 2023

The annual AFIRE survey points to fundamental changes in the office market, deep discounts over the next 12 months, and value-add opportunities galore.

Read More →

One-Billion-Dollar Office Buildings Lose 70% of Market Value

October 13, 2023

In a dramatic examples of price dislocation, bids came in low for an office property that was valued at almost a billion dollars just a few years ago.

Read More →

Banks Retreating from the Commercial Real Estate Market

October 5, 2023

After growing their market share from 8% to 34% of loan originations, smaller banks are now retreating, just when borrowers need them the most.

Read More →

Alternative Lenders Fill the Void Left by Banks

September 28, 2023

Economic and regulatory events are paving the way for private credit funds and other alternative lenders to gain significant market share from banks.

Read More →

Anticipating Opportunities for Office-to-Apartment Conversions

August 14, 2023

Converting underutilized office buildings to multi-family use, an idea that's currently in the spotlight, could offer up more opportunities for investors.

Read More →

SEC Cracks Down on Crypto

June 5, 2023

It's about to get more difficult for the cryptocurrency industry to operate in the United States and perhaps even more difficult for Americans to trade.

Read More →

The Self-Inflicted Crisis of the Debt Ceiling

May 29, 2023

Every time congress puts on this dog and pony show, it’s like playing Russian roulette, except they’re putting the gun against our heads instead of theirs.

Read More →

Join Our Community of Lenders

Expand your understanding of real estate investing beyond the ordinary.

By subscribing to Beyond Lenders, you’ll stay up to date on resources that will supercharge your growth as a real estate debt investor.